PSD2 changes the financial services landscape The new Payment Service Directive 2015/2366 or PSD2 will reshape data and order processing in the financial sector. Not only will banks have to give service providers access to their systems, the customer experience will also change dramatically. In this new environment, it will become increasingly more complex for both banks and service providers using the new PSD2 interfaces to verify whether all banks and functions are operating correctly

Guiding you in this new PSD2 environment During industry events and discussions with our clients, it has become clear that stakeholders need some sort of directory to guide them to the PSD2 interfaces and, where possible, certify or accredit users.

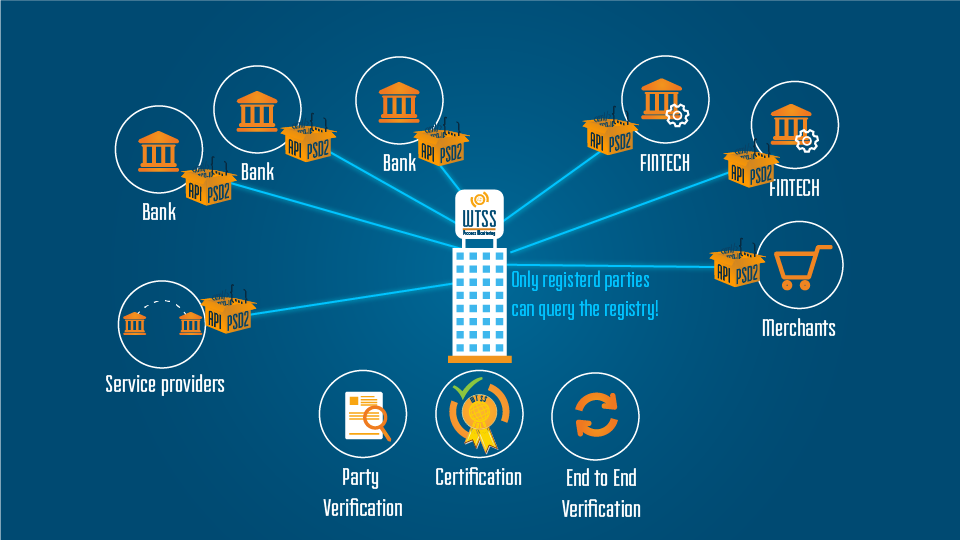

Registration and accreditation open soon As you can see from the above picture, WTSS is taking up the gauntlet. Although we will not be the centre of communication, we would like to certify, test and accredit PSD2 interfaces and service providers, and share these details with the PSD2 community. As a result, WTSS is opening registration of PSD2 interfaces for banks and service providers. And even better, registration is free of charge. As well as creating a ‘PSD2 Yellow Pages’, we will also collect and publish as much information about the interfaces as possible.

Whether you’re a bank or service provider, it all starts with registering on the portal. Registration is free of charge! Depending your role in PSD2, WTSS requires certain information for validation.

Once you have completed registration, the WTSS team will start validating your information. A callback is part of the process in order ensure that contact details are correct. If any information is missing, unclear or incorrect, we will contact you as soon as possible to finalize your registration.

We want to publish detailed information about PSD2 interfaces. For this, another team at WTSS will contact interface operators to get as much information as possible. We will also keep (but not publish) a record of contact people so that we can regularly update information.

WTSS offers a great many services for validating PSD2 interfaces. We can even set up an end-to-end monitoring flow. These additional services increase your certification level.